If your client can’t afford their mortgage payments or is struggling with money, we may be able to help.

We're sorry, but our website is not compatible with the browser you are using.

To get the best experience we would strongly advise using a more recent and compatible browser such as Google Chrome, Mozilla Firefox, Microsoft Edge or iOS Safari.

By working together in partnership, Newcastle for Intermediaries is here to help you provide a smooth and positive experience for all your clients, including those who might need additional support.

Life can be unpredictable, and a life-changing event can happen to anyone at any time. We’re committed to helping you support your clients in navigating these situations and ensuring they get the help they need in a way that suits them.

This page provides information on identifying vulnerable clients and advice on how to support them.

We know you care, and together we want to find the best outcome for every applicant.

Understanding vulnerability

The Financial Conduct Authority (FCA) defines vulnerability as ‘someone who, due to their personal circumstances, is especially susceptible to detriment, particularly when a firm is not acting with appropriate levels of care.’

Vulnerability is often hidden, can be temporary or long-lasting, and can impact anyone. The 2022 Financial Lives Survey revealed that 47% (or 24.9 million) of UK adults showed one or more characteristics of vulnerability.

The FCA identifies four main drivers that contribute to vulnerability:

| Remember | Vulnerability is complex, and people may face multiple drivers at one time. For example, someone with hearing loss may also be experiencing a relationship breakdown. |

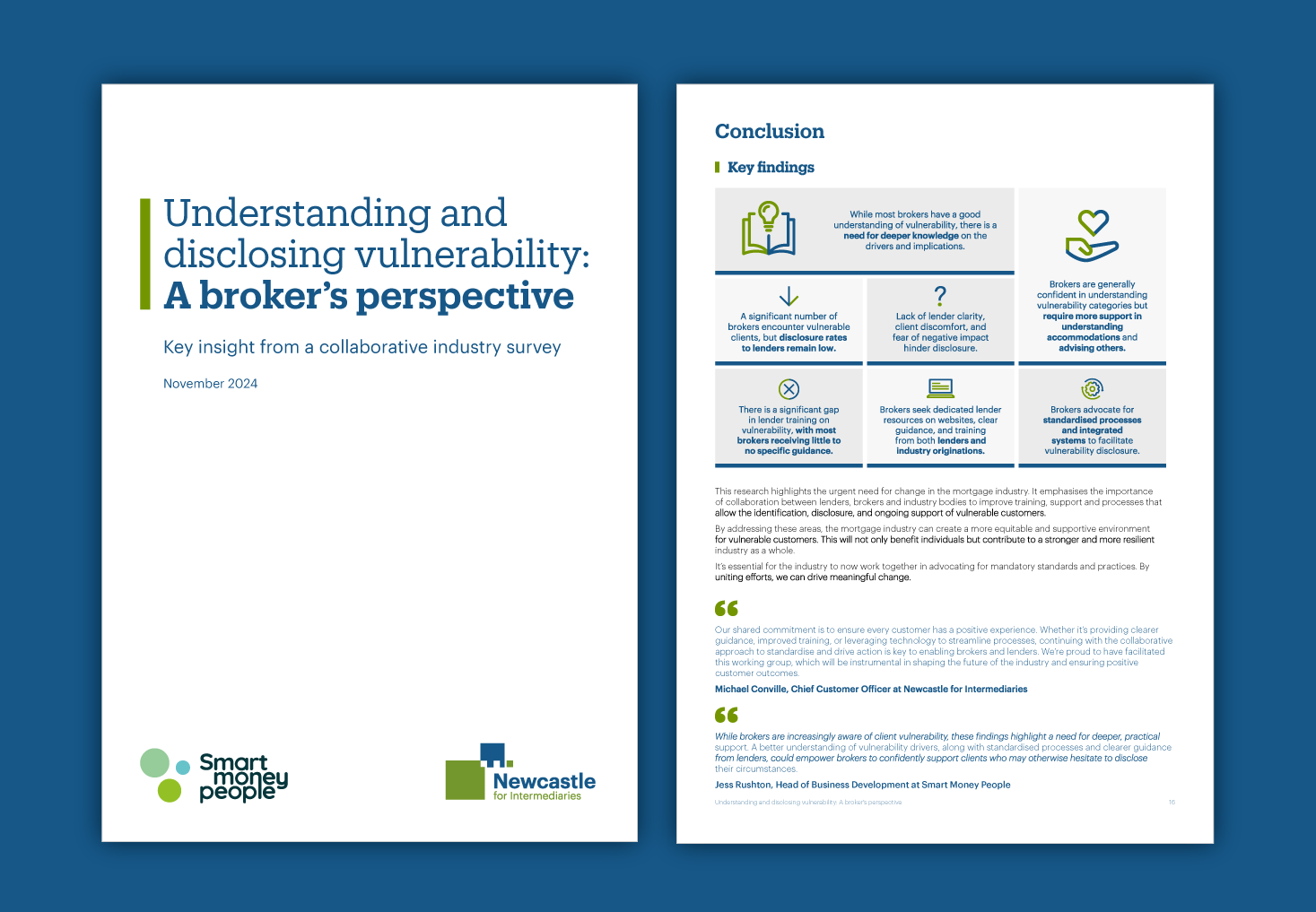

Understanding and disclosing vulnerability: A broker’s perspective

We joined forces with 27 leading lenders, mortgage clubs, industry bodies, and research provider Smart Money People to conduct a comprehensive industry survey into the industry’s current understanding and the challenges faced in identifying vulnerable customers across the mortgage application process.

Identifying vulnerability

When interacting with clients, there are cues that can indicate vulnerability. Some clients may disclose this through a direct statement, such as:

- "I can’t hear well on the phone."

- "I’ve been unwell or in the hospital."

- "I lost my job."

- "My eyesight is poor."

- "I've just gone through a divorce."

Or your clients may be more subtle with a statement such as:

- "I have a lot going on right now."

- "Someone usually helps me with this."

- "I don't know where to start. I’m not very good with numbers."

- "Could you provide a printed copy? I prefer not to use computers."

- "Can you speak to my family member instead?"

| Remember | Vulnerabilities can be disclosed through any communication, including letters or emails. It’s important to look out for these cues even when dealing with ‘admin’ tasks. |

The FCA's BRUCE framework can help identify potential vulnerabilities:

| Behaviour | Do you notice any cues in your client's speech and behaviour? Do they have difficulty speaking clearly, repeat themselves, or show signs of becoming easily agitated? |

| Remembering | Are there any signs that the client may have memory or recall issues? Do they take long pauses before responding, avoid answering questions directly, or try to change the subject? |

| Understanding | Are there any signs that the client is having difficulty understanding the information? Watch out for signs like confusion in their responses, excessive agreement, or saying yes when it doesn't seem right. |

| Communication | Can the client express their thoughts, decisions, and questions clearly? Do they need a third party to assist with communication? |

| Evaluation | Is the client having trouble weighing up all the information? Are they evaluating the advantages and disadvantages of each option? Are they overly dependent on one source of information? |

Powered by Partnership

Every broker has a dedicated Business Development Manager (BDM) to offer advice, explain our support options, and guide you through the application process. Our contact centre team is also trained and ready to support you, or your client, at any stage of the mortgage journey.

Supporting vulnerability

Clients who are vulnerable might find it harder to make good decisions. It's important that every client gets the best possible outcome, even if that means giving additional support.

Ways you can help

If you think a client has a vulnerability, be patient and understanding. They might not want to talk about it or even recognise they need extra help. Whatever the situation, the goal is to understand how they can be supported.

Here are some ways you can help:

Mortgages can be confusing for anyone, given the jargon, acronyms, and level of financial information. By taking the time to understand your clients and explaining things simply, everyone can have a better experience.

| Remember | People don’t always know what support is available, by working together we can help find the best solution. |

Ways we can help

If you have a vulnerable client and they are happy for this information to be shared, please let us know by:

| Including it on their mortgage application | Select 'Yes' for the question 'Are there any circumstances Newcastle Building Society should be aware of for this applicant?' and complete the 'additional support' section. |

| Contacting us | Contact our Intermediary Support team on 0345 602 2338 at any point in the mortgage journey. |

We'll add a flag to the account so if the client contacts us directly, they won't need to mention it again. This helps our team give them the right support every time.

Disclosing a client’s vulnerabilities will never have a negative impact on the client’s application.

This information is confidential and will not be discussed unless there is a need to do so. It can also be edited or removed at any time. With this information, we can improve the way we support your client by:

- Providing information in different formats, such as braille, large print, or audio.

- Offering a translation service for customers with limited English.

- Understanding their preferred communication channels (phone, email, post) and contact times.

Further support

Helping Hand

We fund a full time advice expert at Citizens Advice Gateshead to deliver Helping Hand, it’s a dedicated service that provides expert advice and support.

Mortgage Charter FAQs

As signatories of the Mortgage Charter, we introduced more ways to support your clients who may be worried about mortgage rates.